Communications Systems, Inc. Reports 2014 First Quarter Results

FOR IMMEDIATE RELEASE

Contacts:

| Curtis A. Sampson, Chairman and Interim CEO | (952) 996-1674 |

| Edwin C. Freeman, VP Finance and Chief Financial Officer | (952) 996-1674 |

| Kristin A. Hlavka, Corporate Controller | (952) 996-1674 |

Communications Systems, Inc. Reports 2014 First Quarter Results

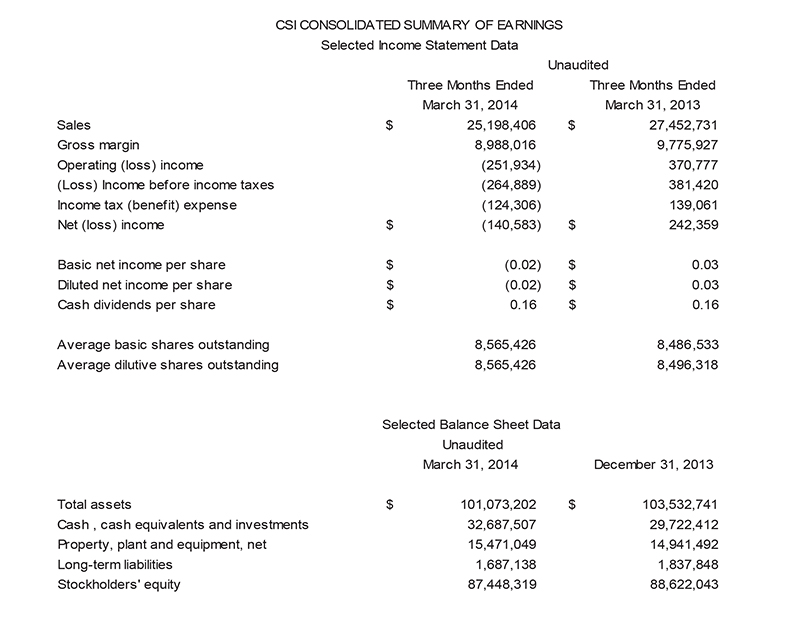

Minnetonka, Minnesota – May 7, 2014 — Communications Systems, Inc. (NASDAQ: JCS today reported financial results for its first quarter ended March 31, 2014.

First Quarter Fiscal 2014 Highlights

- Consolidated 2014 first quarter sales decreased 8% to $25.2 million from $27.5

million in the 2013 first quarter, due to a decline in revenues at its Transition

Networks and JDL Technologies business units. - The Company incurred an operating loss of $252,000 in the 2014 first quarter

compared to operating income of $371,000 in the 2013 first quarter and incurred a

net loss of $141,000, or ($0.02) per diluted share, in the 2014 first quarter

compared to net income of $242,000, or $0.03 per diluted share, in the 2013 first

quarter. - Suttle sales increased 4% to $12.9 million in the 2014 first quarter compared to

$12.4 million in the 2013 first quarter. This represented the eleventh consecutive

quarter in which Suttle posted increased sales as compared to the corresponding

quarter in the prior year. - In March 2014, we announced a multi-million dollar, three-year contract to

supply Suttle’s new FutureLink™ Intelligent Wall Plate System to a major US

communications service provider. This intelligent wall plate is designed to

significantly improve home connectivity on both copper and fiber networks. - Transition Networks’ sales decreased 10% to $9.7 million in the first quarter of

2014 compared to $10.8 million in the comparable 2013 quarter, due primarily to

weakness in our international markets. Our North American sales increased 3%. - JDL Technologies’ sales decreased 39% to $2.6 million in the first quarter of

2014 compared to $4.2 million in 2013, as JDL completed work related to the

Miami-Dade County Public School District district’s “Bringing Wireless to the

Classroom” initiative. - Cash, cash equivalents, and long and short-term investments increased by $3.0

million during the first quarter to $32.7 million as JDL collected a significant

amount of the receivables from its South Florida school district customers. At

March 31, 2014 the Company had positive working capital of $63.3 million.

Chairman and Interim CEO Curtis A. Sampson commented: “As I said in our recently

published annual report, I expect 2014 will be an improving year for CSI. Though not all the

necessary changes of our restructuring are in place yet, and we may experience some business

volatility in the short term, we believe our business portfolio is strengthening, particularly Suttle

and see good prospects for the rest of this year and the future.”

Suttle

Suttle’s 2014 first quarter sales growth is attributable to the following factors:

increased high speed copper and fiber deployments by two of our largest

customers;

2014 first quarter sales compared to 76% of 2013 first quarter sales; and

accounted for 56% of sales.

In addition, international sales declined 48%, due to a reduction in revenue from Austin

Taylor legacy products and our termination of an unprofitable OEM contract. Suttle’s gross

margin increased 5% in the first quarter to $3.5 million compared to $3.3 million in 2013 and

remained stable at 27% of sales.

Transition Networks

Transition Networks’ sales decreased 10% to $9.7 million in the first quarter of 2014

compared to $10.8 million in the comparable 2013 quarter, due primarily to weakness in our

international markets. North America sales increased $197,000 or 3% in the 2014 first quarter

from the same quarter in 2013, while international sales in the same periods decreased $1.3

million or 31%. Gross margin on 2014 first quarter sales decreased 18% to $4.7 million in 2014

from $5.7 million in the 2013 first quarter, and decreased as a percentage of sales in these

respective periods, to 48% from 53% due to unfavorable product mix and pricing pressure.

JDL Technologies

JDL Technologies’ sales decreased 39% to $2.6 million in the first quarter of 2014

compared to $4.2 million in 2013. Revenues earned in Miami-Dade County Public School

District in each of the 2014 and 2013 first quarter were related to that district’s “Bringing

Wireless to the Classroom” initiative for which the district received federal funds under the ERate program to expand wireless connectivity for students and staff. This project was completed in the first quarter of 2014. Because federal and local funding for investments in IT infrastructure and services for K-12 schools varies substantially from year to year, JDL has experienced large swings in its quarterly and annual revenues. Based on recent indications from the federal government, we anticipate that the federal government may not fund the E-Rate program in our traditional South Florida market in 2014, which may result in delays or cancellations in present or future school district wireless infrastruture projects.

Revenue from JDL’s sales to small and medium sized commercial businesses (SMBs)

increased by 48% to $538,000 as a result of JDL’s continued successful marketing and sales

efforts. JDL Technologies’ 2014 first quarter gross margin dollars increased 7% to $791,000

compared to $740,000 in the comparable 2013 period, reflecting the fact that a significant

portion of its 2013 revenue was hardware-based, rather than its more traditional value-added

service.

We expect volatility in JDL’s revenues to continue in 2014 and future years.

Accordingly, in order to reduce its dependence on government funding, JDL continues to

aggressively pursue opportunities to provide managed services, migration to the cloud,

virtualization and other network services to SMBs with a focus on healthcare, legal and financial

services markets.

Further Information

Effective January 1, 2014, the Company realigned financial reporting in regard to operations of its business units to better reflect its move to a holding company business structure that supports self-sustaining business units and to provide increased focus on opportunities to cut indirect corporate charges. As a result of this realignment, all corporate general and administrative expenses that were previously categorized as “Other” are now included within the business unit level as fully allocated costs. In order to conform to the 2014 presentation, the Company has reclassified the previously non-allocated 2013 Corporate expenses within the business segments. Further information regarding the Company’s results and related matters will be provided in the Company’s Form 10-Q report for the three months ended March 31, 2014, which will be filed on May 8, 2014.

Cautionary Statement

From time to time, in reports filed with the Securities and Exchange Commission, in

press releases, and in other communications to shareholders or the investing public,

Communications Systems Inc. may make forward-looking statements concerning possible or

anticipated future financial performance, business activities or plans which are often preceded by

the words “believes,” “expects,” “anticipates,” “intends” or similar expressions. For these

forward-looking statements, the Company claims the protection of the safe harbor for forwardlooking statements contained in federal securities laws. Shareholders and the investing public should understand that these forward-looking statements are subject to risks and uncertainties, including those disclosed in our periodic filings with the SEC, which could cause actual performance, activities or plans after the date the statements are made to differ significantly from those indicated in the forward-looking statements when made.

About Communications Systems

Communications Systems, Inc. provides physical connectivity infrastructure and services

for global deployments of broadband networks. Focusing on innovative, cost-effective solutions, CSI provides customers the ability to deliver, manage, and optimize their broadband network services and architecture. From the integration of fiber optics in any application and environment to efficient home voice and data deployments to optimization of data and application access, CSI provides the tools for maximum utilization of the network from the edge to the user. With partners and customers in over 50 countries, CSI has built a reputation as a reliable global innovator focusing on quality and customer service.